Whether taking an over-the-counter (OTC) drug or one prescribed by a doctor, patients generally assume that medications are safe. How the drug got its approval by the Food and Drug Administration (FDA), which regulates the safety of medicines sold in the United States, is not usually questioned.

The agency, which effectively oversees $2.4 trillion of the U.S. economy, issues warning letters about the safety of drugs that are already on the market. These warnings are at their lowest level since 2008.

Still, a recent report shows that about a third of the medications permitted on the market by the agency between 2001 and 2010 had safety concerns issued later on. These included three withdrawals, 61 boxed warnings — which are meant to call attention to serious risks associated with the drugs — and 59 safety communications. Medications prescribed to treat mental illness and those subjected to an accelerated approval process had more problems.

Dangerous drugs can slip past the FDA and find their way to consumers. Regulations, guidelines and drug laws change as new research emerges, showing negative effects that were unknown before.

Some of the drugs on our list of recalls were approved after 1988 when the government allowed a “fast track” approval process to make medications aimed at treating serious and life-threatening conditions available sooner.

To identify 18 of the worst drug recalls in history, 24/7 Wall St. reviewed scores of reports and safety alerts issued by the FDA, as well as numerous news articles about medications that have been pulled off the market.

1. Thalidomide

Thalidomide, the only non-barbiturate sedative known in the 1960s, was prescribed to treat morning sickness in pregnant women for about six decades. As a result, more than 10,000 children worldwide were born with incapacitating deformities, including missing arms or legs or shortened limbs. The National Institutes of Health describes the drug as the “biggest man‐made medical disaster ever.” Thalidomide never got FDA approval, but about 40 babies were born with thalidomide-related deformities in the United States.

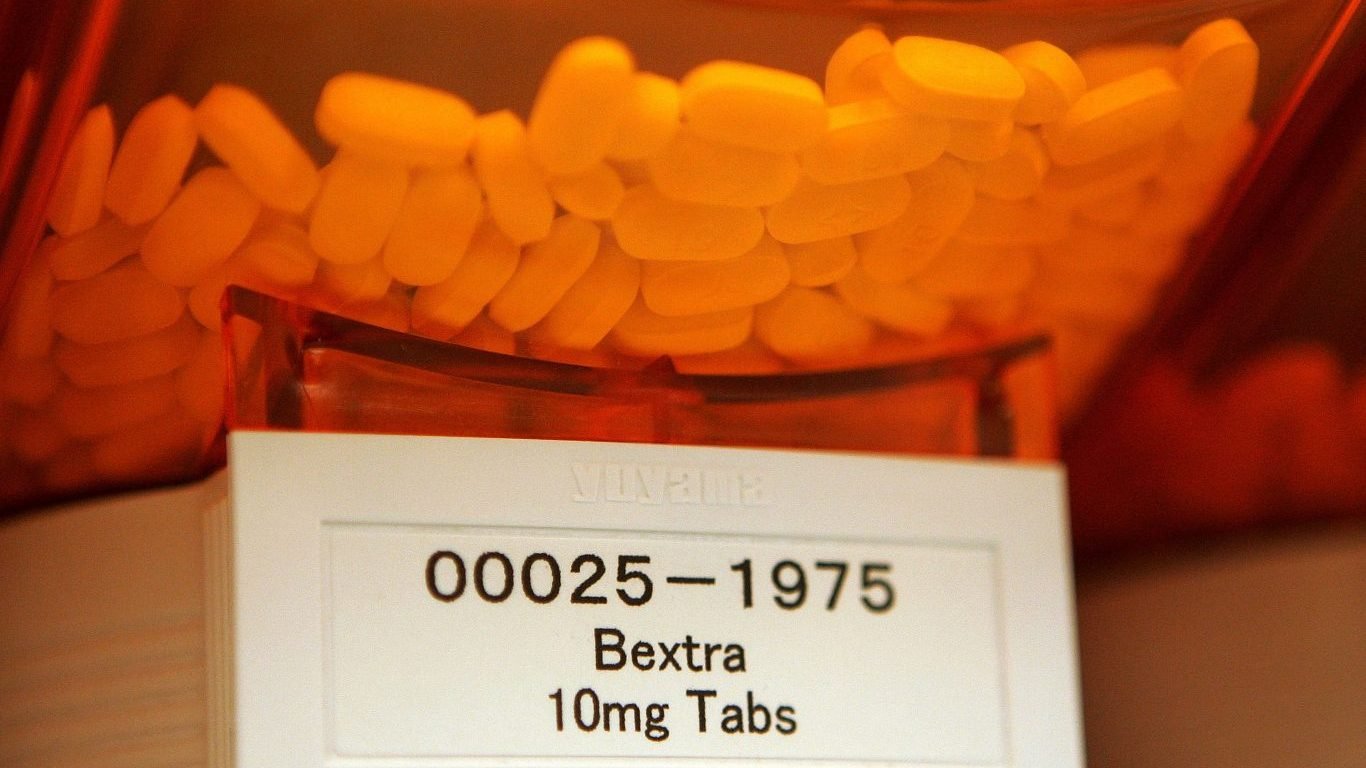

2. Bextra

Bextra, an anti-inflammatory drug made by Pfizer, was a popular medication prescribed for arthritis and menstrual pain. It was pulled from the market in April 2005 because the FDA said it increased the risk for heart and stomach problems, as well as life-threatening skin problems, including Stevens-Johnson syndrome, a severe reaction resulting in blisters both on the skin and internal organs.

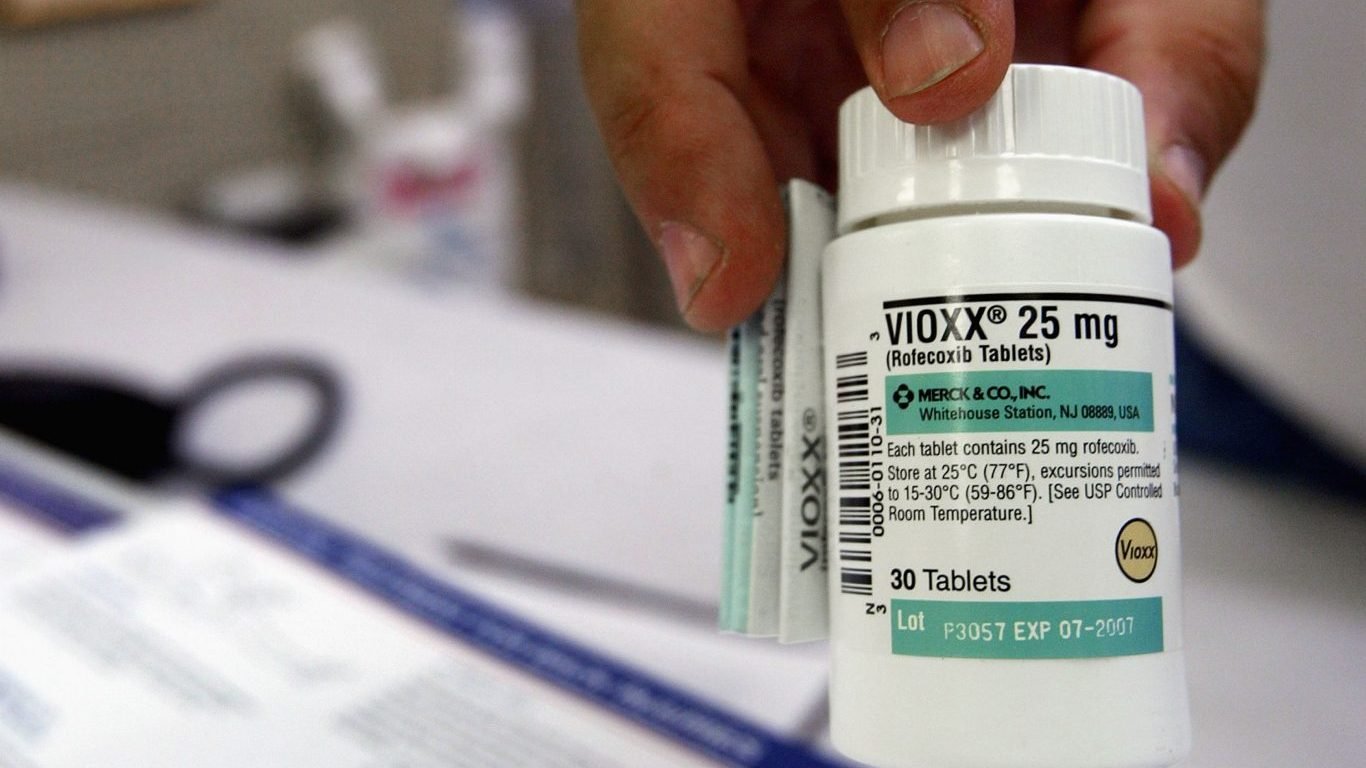

3. Vioxx

Vioxx, a nonsteroidal anti-inflammatory medicine, was taken by about 2 million people around the world. Merck, the drug’s maker, pulled it off the global market in 2004 after determining that the treatment increased the risk of heart attack and stroke. Vioxx had been on the market for five years. A later FDA study determined that Vioxx may have been a contributing cause for over 27,000 heart attacks and sudden cardiac deaths before being withdrawn.

4. Baycol

About 700,000 Americans took Baycol, made by Bayer Pharmaceutical, to lower their cholesterol levels before the drug was withdrawn from the market in 2001. The reason for the recall of the drug, which was also sold under the name Lipobay, was an increasing number of reported cases of muscular weakness, or rhabdomyolysis, as a side effect. The condition causes the muscles to break down and release cells into the bloodstream, potentially causing kidney failure.

5. Rezulin

Rezulin was recalled in 2000 for its toxic impact on the liver. The diabetes drug, which was on the market for three years, was linked to over 60 deaths from liver poisoning. Rezulin had undergone a fast track review process because doctors said it was a new treatment option for diabetics whose condition could not be controlled by other medications.

6. All Able Labs drugs

The nationwide recall of all drugs manufactured by Able Laboratories Inc. in 2005 was due to the FDA’s “serious concerns” that they were not produced according to safety standards. People taking the meds, which were mostly generic, including some drugs containing acetaminophen, were advised to see their doctors to get a prescription for a replacement. The recall put the company out of business.

7. Tylenol

In 1982, more than 31 million Tylenol capsules were withdrawn from the market after several deaths revealed that some were laced with highly poisonous potassium cyanide. At the time, Tylenol was the top-selling over-the-counter pain medication in the country. How, why, and who was responsible is still unknown. One of the latest Tylenol recalls occurred in 2010 when children’s Tylenol grape meltaway tablets, extra strength Tylenol, extra strength Tylenol rapid release gelcaps, and extra strength Tylenol PM geltabs were taken off the market because of a moldy odor and black particles. Some Motrin and Benadryl meds were also recalled.

8. Darvon, Darvocet

Propoxyphene, a pain killer taken by more than 10 million people and sold as stand-alone pills under the name Darvon and as part of other drugs such as Darvocet, was taken off the market in 2010 after it was linked to heart-rhythm abnormalities, which could be fatal. The first petition against the drug, manufactured by Xanodyne Pharmaceuticals Inc., took place in 1978.

9. PPA drugs

The FDA asked companies making drugs that contained phenylpropanolamine, or PPA, to remove them from the market in 2000, due to an increased risk of hemorrhagic stroke, or bleeding into the brain. The agency said that about 6 billion doses of meds containing PPA were sold in 1999 alone. PPA, which has been on the market since the 1970s, was widely used in OTC medicines for cold, such as nasal decongestants and weight loss products.

10. Posicor

Posicor, a pill for hypertension and symptomatic chest pain, was on the market from 1997 to 1998, during which time it was linked to at least four deaths. More than 140 sudden deaths of people who either took the drug or a placebo were reported during a study. The drug, manufactured by Roche Laboratories, was taken by 200,000 Americans. Over 25 other meds were found to have potentially dangerous effects if taken with Posicor.

11. Fenfluramine and dexfenfluramine

Fenfluramine and dexfenfluramine are appetite suppressants that were widely used in the 90s. They were the “fen” part in the commonly known “fen-phen” obesity drugs, and were ordered off the market by the FDA in 1997 after 24 cases of patients with heart disease were linked to them. The “phen” in fen-phen stands for phentermine, which was not banned. Over 100 more cases of people with heart valve problems, who were taking fenfluramine or dexfenfluramine, with or without phentermine, were later reported to the FDA.

12. Seldane

Seldane, one of the most popular antihistamine drugs ever, was used to treat allergies and symptoms such as sneezing, itchy eyes, and runny nose. In 1996 alone, there were more than 6.5 million prescriptions written for Seldane. After 13 years on the U.S. market, it was taken off in 1998 because of its potentially fatal interactions with other drugs such as antibiotics, including heart rhythm abnormalities.

13. DES

Diethylstilbestrol (DES), a synthetic form of estrogen, was given to pregnant women for more than four decades, until 1971, to prevent complications such as premature labor. Between 5 and 10 million pregnant women and children are estimated to have been exposed to DES. DES, now known to be a chemical that disrupts the endocrine system, was also linked to several types of cancer in women who were exposed to the drug while pregnant.

14. Accutane

Accutane used to be prescribed to treat severe acne. More than 13 million took it between 1982 and 2009, when it was withdrawn from the market. The medication, manufactured by Hoffmann-La Roche Inc., can have severe side effects, including birth defects and mental health problems, such as depression and psychosis, if used incorrectly. Other possible side effects include nosebleeds, joint pain, and skin rashes.

15. Duract

The short-term painkiller was on the market for about two years until 1999. About 2.5 million prescriptions were written for it. Wyeth-Ayerst Laboratories, which manufactures the medication, took it off the market because, if it’s taken for longer than 10 days, it can increase the risk of liver injury. Among the 200,000 to 400,000 people who took Duract for longer periods of time, there were four deaths, eight liver transplants, and 12 others with serious liver damage reported. Some patients had jaundice and severe hepatitis.

16. Meridia

The FDA recommended against prescribing Meridia, an appetite suppressant, in 2010 due to a 16% increased risk of developing heart problems, including irregular heartbeat, non-fatal stroke, and cardiac arrest. The obesity drug produced by Abbott Laboratories was on the market for 13 years and was prescribed to people with a body mass index of 30 or higher.

17. Omniflox

The antibiotic, also known under its chemical name temafloxacin, sold by Abbott Laboratories, was recalled by the FDA after at least 50 reports of severe reactions to the medication, including low blood sugar, as well as kidney dysfunction and anemia, and three deaths. Omniflox was on the market for about a year until 1992.

18. Palladone

Palladone, a potent narcotic painkiller, was recalled in 2005 after only a year on the market. The drug’s manufacturer, Purdue Pharma, withdrew it due to possible serious side effects if the medication was taken with alcohol. This combination could lead to an instant release of hydromorphone, causing a high drug level in the body, which could depress or stop breathing, leading to coma and even death.